Fast decisions

We’ll aim to give you an instant decision or we’ll let you know within 1 working day and put the money into your account the same day!

Your circumstances considered

Fair and affordable credit. We consider all circumstances.

Flexible repayments

Repay weekly, fortnightly or monthly by debit card, standing order or from your benefits. No fee if you need to change.

A Credit Union is a financial cooperative owned and controlled by its members. Much like a High Street bank, Credit Unions can provide savings, loans and a range of services to their members. Unlike a bank, Credit Unions do not have to answer to shareholders or investors. So the emphasis is always on providing the best service to members – not maximising profits.

Are you looking to borrow money? Using a Credit Union could be the right decision.

Personal Loan Interest rates:

The interest rate depends on the amount you borrow from Clockwise

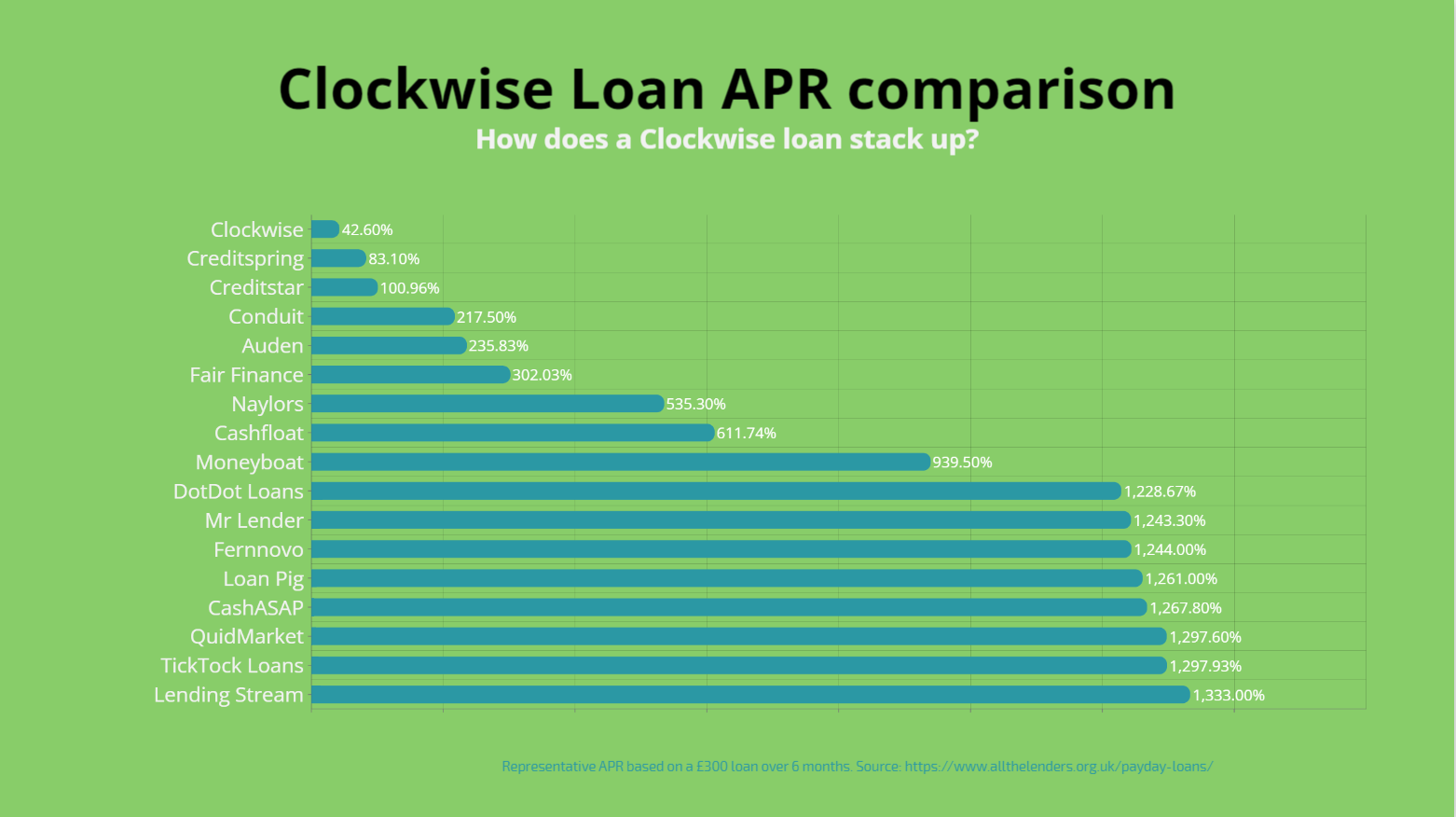

- From £50 to £2,999 at 42.6% APR*

- From £3,000 to £7,500 at 16.1% APR*

There are no application fees or early repayment fees.

Apply for a Back to School Loan

✅ Quick Decisions

✅ Repayments To Suit You

✅ No Application Fees

✅ No Early Repayment Charges

✅ Benefit Incomes Accepted

Borrow from £50 to £2,999 at 42.6% APR

The maximum any credit union will ever charge for a smaller loan is 3% per month on the reducing balance, which works out as 42.6% APR. This means the most expensive credit union loan in Britain is still eight times cheaper than a payday loan charged at their cap.

While highstreet Banks may be able to lend with a lower APR than a Credit Union, banks usually require a very strong credit history which can make it difficult to be accepted. As a Credit Union, we consider all circumstances and Credit History.

Member Reviews

Things you should know

- You must be up to date on any current or previous borrowing with Clockwise Credit Union.

- You must have the disposable income to meet the loan repayment.

- Maximum loan term is 60 months.

- Minimum loan term is 60 days.

* All loans are subject to status and approval. Terms and conditions apply. If you do not meet the criteria for a specific lending rate, or if you are unwilling to accept any special conditions that apply, then we may offer you an alternative loan at an alternative rate.

FAQ

Clockwise offer basic loans from as little as £50 up to £15,000 depending on individual circumstances. This means we look at your income and outgoings to see how much disposable income you have (what is left over after you have paid for your essential living expenses). This tells us how much you could afford to pay back every week, fortnight, or month. If you have requested more than you can afford to pay back we may offer you a lower amount.

There are three main ways to make loan repayments. These are by standing order from your current account (either Clockwise current account or any other), having benefits or wages paid into your share account or via payroll membership where the loan repayment is deducted directly from your wages/salary.

As an ethical lender we aim to keep the costs of our loans at an affordable rate of interest. If we were to provide doorstep lending this would dramatically increase our costs and therefore increase the rate of interest we are able to offer.

Please make contact with us for help and support in the first instance or contact a money advice organisation for information.

We consider all loan applications carefully. If you can provide evidence that you are trying to repay and resolve your previous debts we will consider giving you a loan. In addition we may be able to help you consolidate some or all of your existing debt into one affordable repayment. We assess each applicant individually analysing income and expenditure so our loan decisions are based on your ability to repay the amount you borrow. If we feel you would be worse off by borrowing we will refer you to an agency that can help.

Too give you a loan we need to get to know you as an individual and to fully understand your financial position. The information we may ask for gives us an overall picture of the amount you can afford to repay on a loan amount requested and will inform part of our decision on whether to grant the loan. All the information you provide is confidential and only used to assess your loan application.

We do not lend money to people who would not be able to afford to pay the loan back as it would not be in their best interest and make matters worse.

If you have been turned down for a loan, you might want to consider saving a little or perhaps opening a budget account to help get yourself back on track. It will help us build a relationship with you so next time perhaps we can say yes

A credit rating is a summary of your borrowing history. Every time you apply for credit such as an overdraft, loan, credit or store card the lending organisation will do a search on your name and address to see whether you pay back your loans. If they grant you credit and you fail to make a payment or are late in making a payment they will record this with a credit reference agency. If you pay on time this is also noted. Paying on time increases your rating, paying late or failing to pay decreases your rating. You can check your credit history by visiting Experian, Equifax or TransUnion

We do not lend money to people who would not be able to afford to pay the loan back as it would not be in their best interest and make matters worse.

If you have been turned down for a loan, you might want to consider saving a little or perhaps opening a budget account to help get yourself back on track. It will help us build a relationship with you so next time perhaps we can say yes

Your credit rating will be low if you have never borrowed money or you have never paid for household bills in monthly installments (a form of credit). It seems strange, but it tells a business that is interested in your credit worthiness that you cannot prove you are able and willing to pay back a loan/credit card/mortgage/bill etc. The first thing you should do if you want to build a good credit history is to register where you live with the electoral roll. To find out more about building a credit history we couldn’t do better than Martin Lewis’s advice on his Money Savings Expert website. There is also a useful tool to help you understand your own credit history which you may find helpful beofre applying for your loan.

We do not lend money to people who would not be able to afford to pay the loan back as it would not be in their best interest and make matters worse.

If you have been turned down for a loan, you might want to consider saving a little or perhaps opening a budget account to help get yourself back on track. It will help us build a relationship with you so next time perhaps we can say yes

You must complete all parts of the form that are relevant to you.

Page 2 Proof of Income and Outgoings

We require evidence of all your income and outgoings. There is tick list to help you check you have everything we require.

Page 3 Loan Application Form

Please ensure you complete all fields. It is important you provide details of any previous addresses together with your employer details (if applicable).

Page 4 Purpose of Loan

Please provide us with the reason you require the loan together with repayment details. Note that the repayment amount may be set higher or lower than your preferred amount depending on the amount you wish to borrow.

Page 5/6 Budget Planner

It is important you take time to complete all fields that apply to you providing a true account of your income and expenditure with any information on money you owe. We also require you to complete the check boxes at the bottom of page 6.

Page 7

Please ensure you read, sign and date the declaration before submitting your application form to one of our branch offices.

If you do have further questions, please contact a member of our staff who will be happy to assist you.

We do not lend money to people who would not be able to afford to pay the loan back as it would not be in their best interest and make matters worse.

If you have been turned down for a loan, you might want to consider saving a little or perhaps opening a budget account to help get yourself back on track. It will help us build a relationship with you so next time perhaps we can say yes

When you apply for a loan with Clockwise we will check your credit history using TransUnion, Experian or Equifax. If you have been turned down for a loan it is likely to be for one or more of the following reasons:

- You already owe a lot of money to other lenders

- You have a low credit score or no credit history

- You cannot afford to borrow the amount asked for

- You are not taking responsibility for previous bad debt

What to do next?

- Do not keep applying. Several applications in a short space of time may make lenders think you are desperate for cash and this will affect your credit history further.

- Try saving a little. If you can prove to Clockwise that you can pay the loan repayment amount as savings, you will be able to prove that you can afford the repayments when you are next eligible to apply (normally 4 months).

- Try our budget account. If you are often late with paying your bills or have an outstanding debt, a Clockwise budget account can help you put aside and safeguard money for your bills. Paying on time will help repair your credit history.

- Get help. If you are financially over stretched, getting a loan might not be the best course of action as it will add to the pressure. You may need to see someone who can help you sort through your finances. You can come and talk to Clockwise who often arranges for money advisers to operate from its branch in Leicester. Also see our financial wellbeing page

- Get clued up. There is a lot of tools, advice and help out there for anyone struggling with money. Try the Money Advice Service (Ask Ma! from the TV adverts). This page is a good place to start

Yes, subject to our refund policy which you can view here

If you are repaying your loan via a continuous card payment authority you may cancel this arrangement at any time. To cancel the arrangement you can contact us or your card issuer.

No. You will need to contact the branch to ask for the funds you save while you borrow to be transferred to your Clockwise savings (share) account.